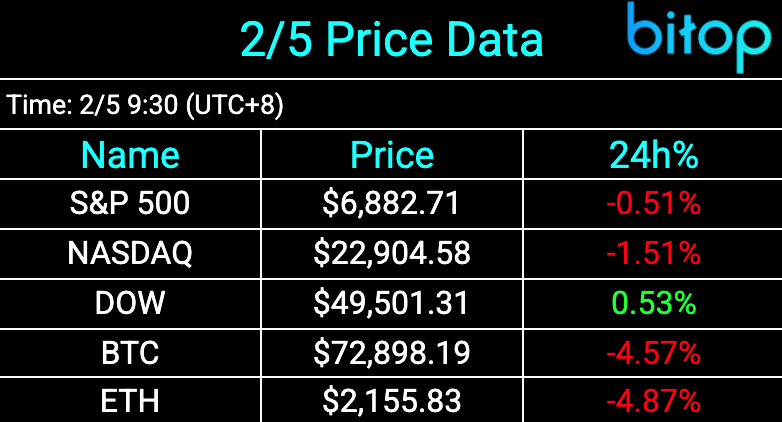

[Bitop Review] Tech Sell-Off Intensifies, Bitcoin Falls to $71K

2026年02月05日发布

AMD shares dragged down the broader market as the sell-off in technology stocks intensified, prompting investors to rotate into cyclical stocks like Walmart, resulting in a sell-off across major indices. Bitcoin suffered heavy losses this week, plunging to as low as 71,888 this morning, a level not seen since November 2024.

Weak Labor Market, Tech Stocks Continue to Plunge

ADP released its monthly private sector employment data for January on Wednesday, showing an increase of only 22,000 jobs, falling short of economists' forecast of 45,000. Due to the previous partial government shutdown, the Bureau of Labor Statistics' Non-Farm Payrolls report, originally scheduled for Friday, has been postponed.

AMD shares weighed on the broader market as the tech sell-off deepened, with investors shifting capital into cyclical stocks such as Walmart. The wave of selling in the tech sector reflects growing investor concerns regarding overvaluation, excessive spending levels, and the potential for artificial intelligence to cannibalize existing software business models. Alphabet shares fell approximately 2% in after-hours trading, serving as the latest example of high spending concerns following the company's announcement of an ambitious capital expenditure plan.

Bitcoin Dips to $71K

Bitcoin has seen severe declines this week, dropping to $71,888 this morning—its lowest point since November 2024. Currently, Bitcoin is down more than 40% from its all-time high of approximately $126,000 set last October.

The token's value is dropping sharply due to geopolitical and economic challenges, among other headwinds.

A note sent to clients by Citi on Tuesday indicated that analysts view $70,000 as a critical level to watch closely as Bitcoin's price decline deepens.

Recent analysis from Deutsche Bank points out that expectations of a more significant correction in Bitcoin, coupled with massive institutional outflows, have led to reduced liquidity for the token, further damaging its price.

Since the liquidation of a series of highly leveraged digital asset positions last October, Spot Bitcoin ETFs have seen significant capital outflows. Over the past three months, outflows have reached as high as $6.2 billion.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.