[Bitop Review] Is the Washout Complete? The Key Scenario for Bitcoin's 2026 Bull Market Restart

2026年01月08日发布

As 2026 begins, the Bitcoin market has undergone significant chip redistribution and structural resetting. Following a slowdown in profit-taking sell pressure, prices have rebounded from the low $80,000s to near $94,000, indicating a gradual repair in market sentiment. However, a Glassnode report points out dense overhead supply, which remains the biggest resistance for future price action. The current market focus is on whether Bitcoin can effectively breach the Short-Term Holder (STH) Cost Basis, viewed as a critical watershed for confirming a trend reversal. Meanwhile, structural changes in institutional funds and the derivatives market offer important clues for downside support.

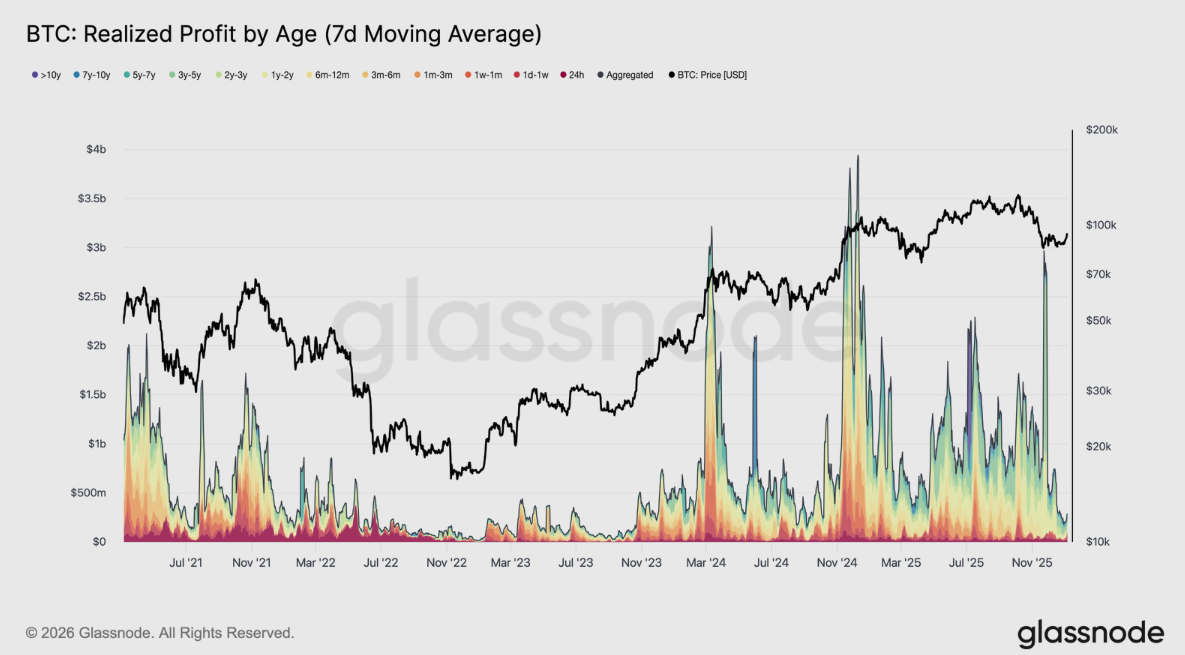

Profit-Taking Pressure Eases

In the first week of 2026, Bitcoin broke out of the long-term consolidation range near $87,000, rising approximately 8.5% to reach $94,400. This rally emerged after a significant alleviation of market profit-taking pressure. In late December 2025, Realized Profit (7-day moving average) dropped sharply to $183.8 million per day, far below the $1 billion daily highs seen throughout most of Q4. As selling power weakened, the market stabilized and regained rationality, supporting new upward momentum. Thus, the early January breakout reflects an effective reset of profit-taking pressure, allowing prices to climb.

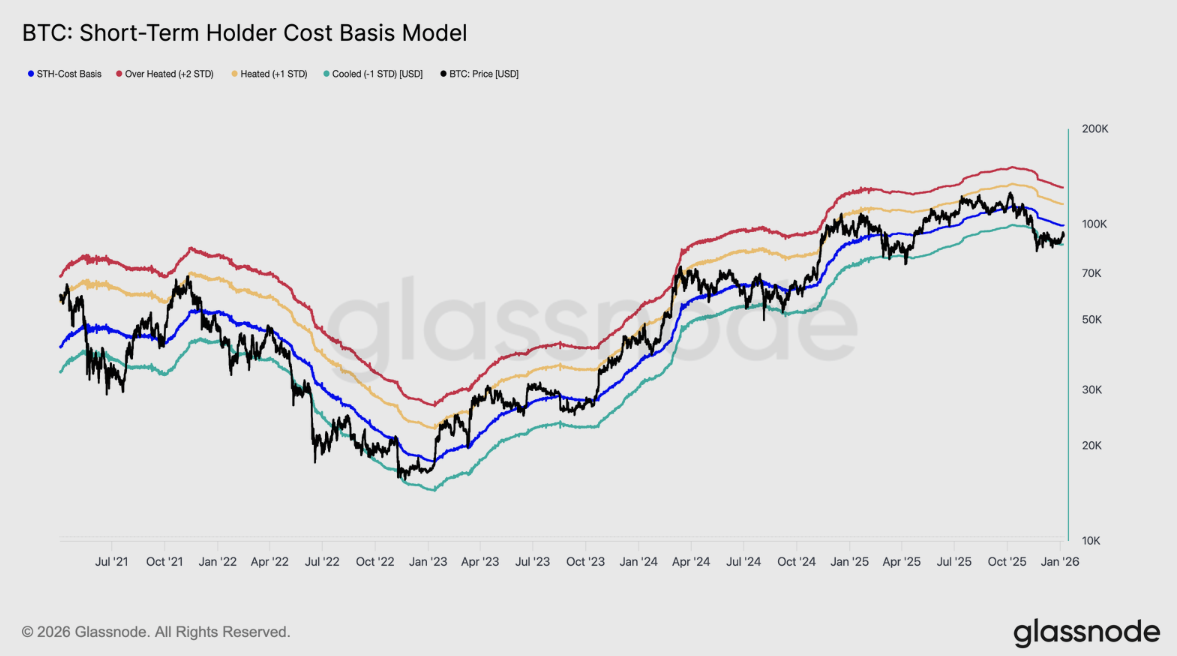

Overhead Pressure: Breaking STH-MVRV is Key to Trend Confirmation

Despite the current rebound, Bitcoin is entering a structurally heavy supply zone. Data shows a massive amount of chips accumulated by recent buyers distributed between $92,100 and $117,400. Most of these investors entered near cycle highs; as prices recover, they face the temptation of "Breakeven Selling," forming natural price resistance.

Currently, the STH-MVRV (Short-Term Holder Cost Basis Model) indicator stands at 0.95, meaning recent investors are still sitting on an average unrealized loss of about 5%. Only by reclaiming and holding firm above the Short-Term Holder Cost Basis (STH-MVRV > 1) can we confirm that the confidence of new market participants has been restored, marking a shift in market dynamics from defensive to constructive. Otherwise, if prices remain suppressed below this level for too long, confidence-driven demand may erode again. The Short-Term Holder Cost Basis is currently located at $99,100.

(Note: The MVRV Ratio compares market cap to realized cap to judge if BTC is overvalued or undervalued relative to "holding cost." STH-MVRV only counts coins held for less than 155 days.)

Downside Support: A Defensive Buffer Built by Institutional Funds

While overhead pressure is heavy, the downside support structure is gradually strengthening. Flows into US Spot ETFs have pivoted, turning from net outflows at the end of 2025 to net inflows, indicating that institutional investors are showing renewed willingness to accumulate in the low $80,000 zone.

Additionally, while buying from Digital Asset Treasury (DAT) companies shows "event-driven" and "intermittent" characteristics rather than sustained structural buying, their significant intervention during price corrections provides a crucial bottom buffer for the market. This "buy the dip" behavior, combined with the return of ETF funds, has constructed a relatively thick line of defense in the $80,000 to $90,000 range, limiting the space for further price collapse.

Derivatives Momentum: The Acceleration Zone After $95k

After a 45% washout in Open Interest at year-end, the derivatives market layout presents a structure more favorable to bulls. As traders shift toward buying Calls, Market Makers' Gamma exposure has flipped to Short Gamma in the $95,000 to $104,000 range.

This means that once Bitcoin breaks $95,000, Market Makers will be forced to buy spot or futures to hedge risks as prices rise. This mechanical buying will fuel price volatility. Unlike the Long Gamma positioning at year-end that suppressed volatility, the current structure no longer limits upside but may trigger accelerated price action upon breaking key levels. Therefore, $95,000 can be seen as the trigger point for starting a short-term explosive rally.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.