[Bitop Review] Bitcoin Crashes to $88K: Can Nvidia Earnings Save the Crypto Market?

2025年11月20日发布

The S&P 500 index ended its four-day losing streak, as the Federal Reserve released its October meeting minutes showing divided opinions. Traders' expectations for a 25-basis-point rate cut on December 10 have dropped to 32%. Bitcoin (BTC) has fallen more than 10% over the past week, reaching a low of $88,608 last night, while Ethereum (ETH) also dropped to $2,873. Although the crypto market saw some gains following Nvidia's strong earnings announcement, overall sentiment remains very fragile, with the Fear & Greed Index still in the extreme fear zone at 16. A report from K33 states that leverage has intensified during this rapid correction, presenting a dangerously fragile structure, and BTC could potentially pull back to 84K-86K.

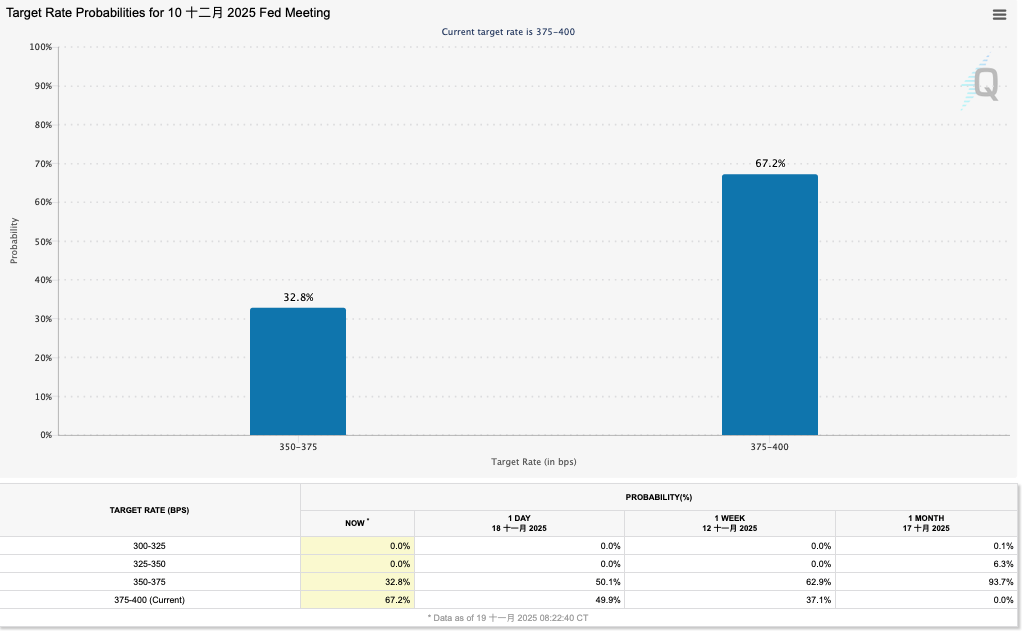

Fed Meeting Minutes Show Divisions, December Rate Cut Expectations Plummet

The Fed's October meeting minutes indicate that many central bank officials believe it may be appropriate to keep interest rates unchanged for the remainder of 2025. According to the CME FedWatch Tool, traders' probability of a 25-basis-point rate cut on December 10 has fallen to 32%. Due to missing data and uncertainty over tariff impacts, market uncertainty is high.

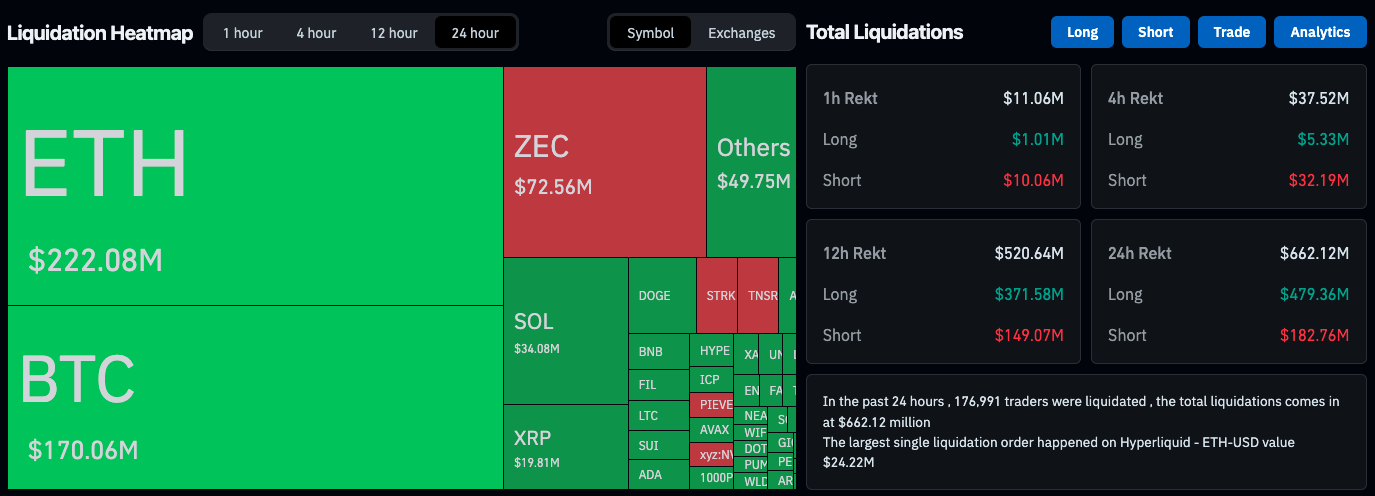

Bitcoin Drops to 88K, Liquidations Across the Network Reach $662 Million

Bitcoin has fallen more than 10% over the past week, reaching a low of $88,608 last night—the lowest since late April.

Ethereum (ETH) also dropped to $2,873 yesterday, with $662 million in positions liquidated across the crypto market in the past 24 hours. ETH accounted for the largest share at $222 million, followed by BTC at $170 million.

Although the crypto market saw some gains following Nvidia's strong earnings announcement, overall sentiment remains very fragile, with the Fear & Greed Index still in the extreme fear zone at 16.

K33: Leverage Intensifies During Correction, BTC Could Pull Back to 84K-86K

The Bitcoin derivatives market is exhibiting a dangerous and structurally concerning pattern as described by K33, with traders adding aggressive leverage during a deepening correction that has caused Bitcoin to fall more than 10% over the past week, reaching a low of $88,608 last night—the lowest since late April.

The report states that open interest in perpetual futures has increased by over 36,000 Bitcoin, the largest single-week gain since April 2023, while funding rates are also rising, indicating that traders are engaging in "catching a falling knife" rather than defensive positioning.

“The growing funding rates likely stem from resting limit orders being filled in hopes of a swift bounce with prices pushing below 6-month lows. However, no bounce has materialized, and now, this leverage represents excess overhang, increasing risks of amplified volatility driven by liquidations.”

In contrast, CME futures premiums are near yearly lows, and the term structure remains narrow, reflecting ongoing risk-averse sentiment among institutional participants. K33 warns that historically, such divergences often foreshadow further price declines.

K33 estimates the potential bottom to be between $84K and $86K, and if selling pressure intensifies, it could drop further to the April low of $74,433.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.