[Bitop Review] Wall Street Legend Paul Tudor Jones Favors Bitcoin Over Gold, Says Stock Market Has Significant Upside Potential

2025年10月07日发布

In the context of ongoing global macroeconomic turbulence and unrelenting inflationary pressures, legendary hedge fund manager Paul Tudor Jones has spoken out again, emphasizing that Bitcoin holds greater advantages over gold in a world of fiscal expansion. He also anticipates that the stock market rebound has substantial room to run before reaching what he calls a "blow-off top," advising investors to prepare their asset allocations accordingly.

Paul Tudor Jones: The Legendary Manager Who Early Supported Bitcoin

Paul Tudor Jones is an iconic American hedge fund manager, philanthropist, and market prognosticator, hailed as one of Wall Street's most insightful traders.

He founded Tudor Investment Corporation in 1980, focusing on global macro trading. He gained fame in 1987 during the "Black Monday" stock market crash by successfully predicting the market collapse.

Paul Tudor Jones was one of the first major Wall Street figures to publicly support Bitcoin. He revealed his stance in 2020, when central banks implemented unprecedented monetary stimulus measures. In recent years, Jones has repeatedly stated publicly that Bitcoin is more appealing than gold in the current macroeconomic environment, particularly amid ongoing fiscal expansion and inflationary pressures.

Jones: Bitcoin Has Greater Advantages Than Gold

Jones recently stated on CNBC: "Gold has its role, but in a world of fiscal expansion, Bitcoin's fixed supply and decentralized nature give it a clear edge."

He noted that his portfolio's exposure to cryptocurrencies remains at a "single-digit" level. He added that the global financial system is entering an increasingly digital era, where Bitcoin's fixed supply makes it an excellent hedge against rising prices.

He also sees structural trends shifting toward digitization and alternative monetary systems. He believes Bitcoin is highly attractive in the current macroeconomic environment and that its performance will outperform all other asset classes.

While gold is a long-standing safe-haven asset with its merits, in a world of monetary stimulus and fiscal expansion, Bitcoin's fixed supply and decentralized nature provide it with an advantage.

Jones added that Bitcoin's appeal is not merely speculative; its importance as a tool for portfolio diversification and an inflation shield is growing.

Stock Market Still Has Significant Upside, Like October 1999

Additionally, Jones anticipates that the stock market rebound has substantial room to run before reaching his so-called "blow-off top," and he advises investors to prepare their asset allocations.

On the CNBC program, he compared the current market to October 1999, when the Nasdaq index surged dramatically from the first week of October and doubled by March 2000. He believes the current stock market could experience explosive growth similar to the dot-com bubble, driven by factors such as low inflation and AI-fueled prosperity.

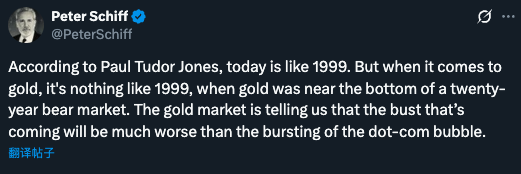

Peter Schiff: Gold's Strength Signals an Impending Depression

However, gold bull Peter Schiff rebutted Paul Tudor Jones' comparison of the current market to the 1999 internet era, arguing that the current strength in gold prices foreshadows an impending depression that will be more severe than the bursting of the dot-com bubble.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.