[Bitop Review] Shocking PNUT Surge: 36% Gains and POL Breakout Secrets – Will THETA Explode Next in Crypto Market Update?

2025年09月16日发布

PNUT

Since our analysis on September 3, PNUT has risen all the way, breaking out of the triangle pattern, with gains once reaching nearly 36%, before encountering resistance at $0.2824 and pulling back. As of writing, it is temporarily reported at $0.2366, which is about 14% away from the initial entry point. Investors who have established positions based on the analysis can choose to partially close their positions and move the stop-loss price up to the entry point.

Investors who have not yet entered the market do not need to panic. This breakout followed by resistance can be seen as a normal pullback, with the price currently testing the support zone. Investors can choose to enter long positions at market price or establish long positions at $0.23. Take-profit targets can be set in batches at $0.293, $0.306, $0.33, and $0.34. The stop-loss can be set according to personal risk tolerance, options include $0.218 or $0.208.

Reference Points:

Direction: Long

Entry: $0.236 (market price) - $0.23

Take-Profit: $0.293 / $0.306 / $0.33 / $0.34

Stop-Loss: $0.218 / $0.208

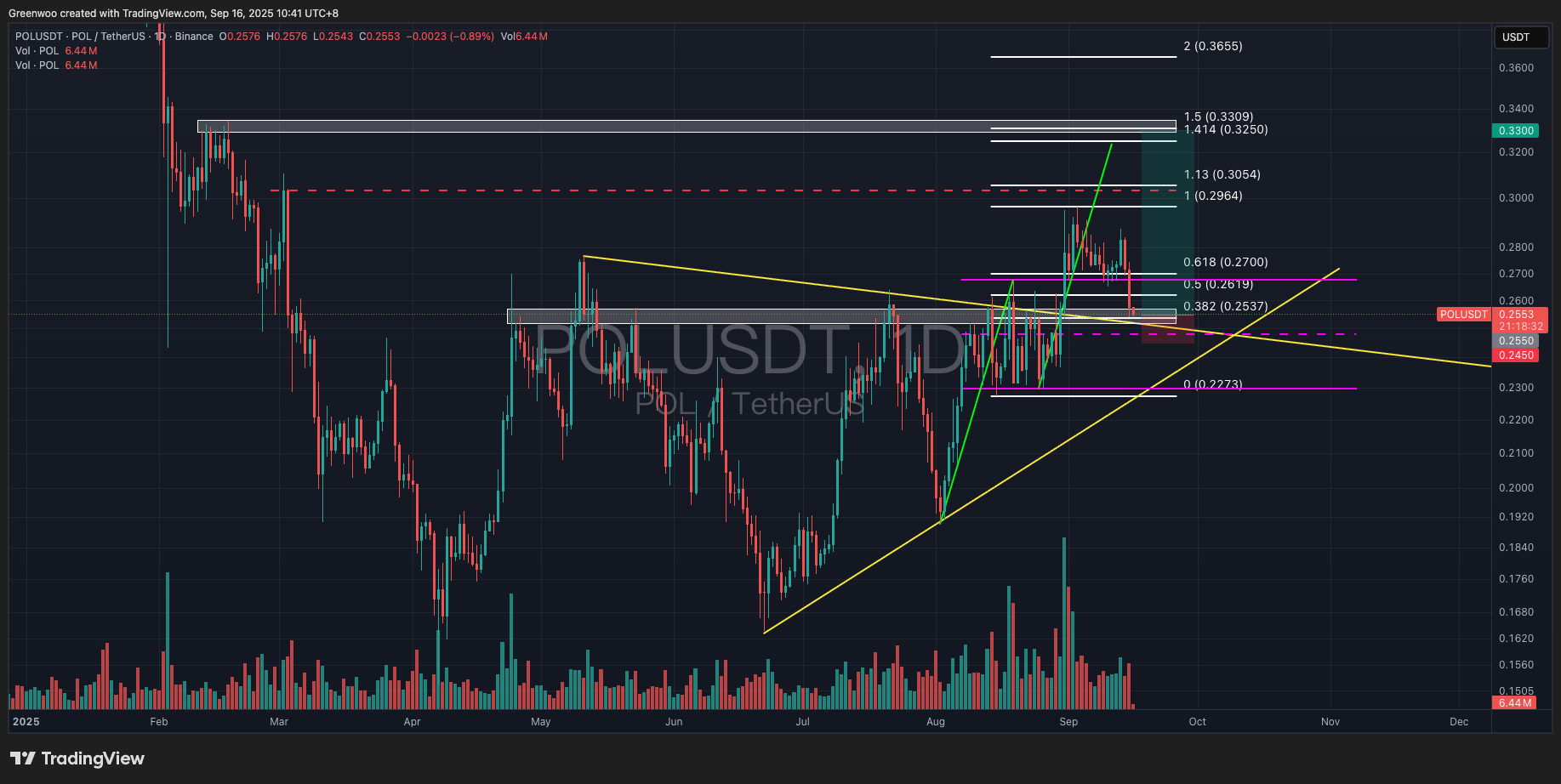

POL

POL recently broke out of the flag pattern and encountered resistance at $0.2964 before pulling back. The price found support and rebounded around $0.265 (i.e., Fibonacci 0.618), but soon encountered resistance again and fell. As of writing, it is temporarily reported around $0.255, which is approximately equivalent to the Fibonacci 0.382, above the trend line, and the support zone—three key points converging.

If the price successfully holds this zone, investors can choose to enter long positions at market price. Take-profit targets can be set in batches at $0.3, $0.325, and $0.33. The stop-loss can be set according to personal risk tolerance, options include below the flag midpoint at $0.248 or the flag low at $0.227.

Reference Points:

Direction: Long

Entry: $0.255

Take-Profit: $0.3 / $0.325 / $0.33

Stop-Loss: $0.245 / $0.227

THETA

THETA recently broke out of the triangle pattern and encountered resistance at $0.882 before pulling back. The price retraced to $0.793 and then briefly rebounded. The bottoming point is approximately equivalent to the convergence of Fibonacci 0.382, the trend line, and a high-volume trading area, indicating strong support.

As of writing, it is temporarily reported at $0.8. Investors can choose to enter long positions at market price. Take-profit targets can be set in batches at $0.888, $0.92, and $0.96. The stop-loss can be set according to personal risk tolerance, options include $0.776 or $0.744.

Reference Points:

Direction: Long

Entry: $0.8

Take-Profit: $0.888 / $0.92 / $0.96

Stop-Loss: $0.776 / $0.744

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.