[Bitop Review] Massive Funds Flow into ETFs, Bitcoin Breaks $120,000 to Hit New All-Time High!

2025年07月14日发布

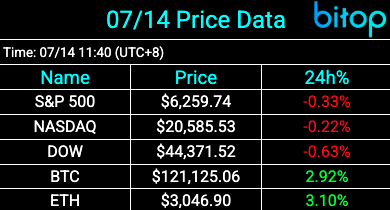

U.S. President Trump announced over the weekend that a 30% tariff on goods from the EU and Mexico will take effect on August 1, causing U.S. stock index futures to decline on Monday. However, Bitcoin surged past $120,000 today, reaching a new all-time high of $121,492, just shy of the $120,000 mark. Ethereum also broke through the $3,000 barrier. Recently, funds have been continuously pouring into ETFs, with Bitcoin spot ETFs reaching a total asset size of $150.6 billion, while Ethereum spot ETFs have hit $13.5 billion.

Continuous Capital Inflows into ETFs

Bitcoin broke through $120,000 today, setting a new all-time high at $121,492. Bitcoin spot ETFs have seen net inflows exceeding $1 billion for two consecutive days, with total assets reaching $150.6 billion, accounting for 6.43% of Bitcoin’s market capitalization. BlackRock’s IBIT alone holds over half of this share, with assets totaling $84.2 billion.

Ethereum spot ETFs have also seen significant inflows, with net inflows of $210 million, $380 million, and $200 million over the past three days, bringing total assets to $13.5 billion, or 3.77% of Ethereum’s market capitalization. BlackRock’s ETHA accounts for nearly half of this, with assets of $6.14 billion.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.