[Bitop Review] Crypto Analysis: 1INCH, ENA, ORDI

2025年07月09日发布

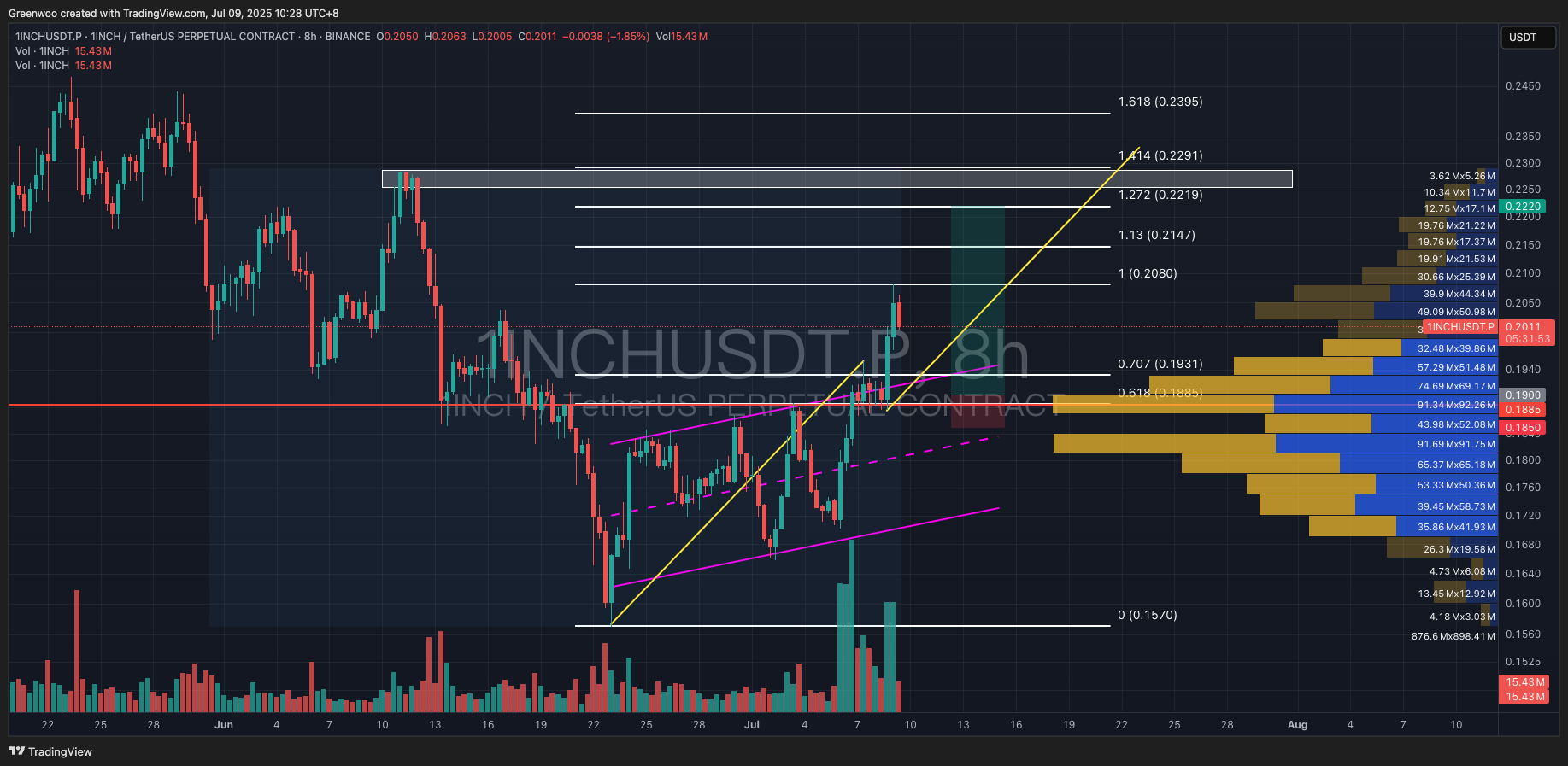

1INCH

Since July 5, 1INCH has experienced a strong upward trend, breaking through the ascending channel on July 8 before facing resistance around $0.208 and pulling back. This rally shows a clear trend of rising prices accompanied by increasing volume, signaling an effective bullish breakout. If the price tests the support zone downward, it may present a buying opportunity.Investors can consider entering long positions in the high-volume trading zone between $0.188 and $0.193. More conservative investors may opt for an entry near $0.182. Take-profit levels can be set in batches at $0.215, $0.22, and $0.23. Stop-loss levels, depending on the entry price, can be set at $0.185 or $0.179.

Reference Levels:

Direction: Long

Entry: $0.1825 / $0.188 - $0.193

Take Profit: $0.215 / $0.22 / $0.23

Stop Loss: $0.185 / $0.179

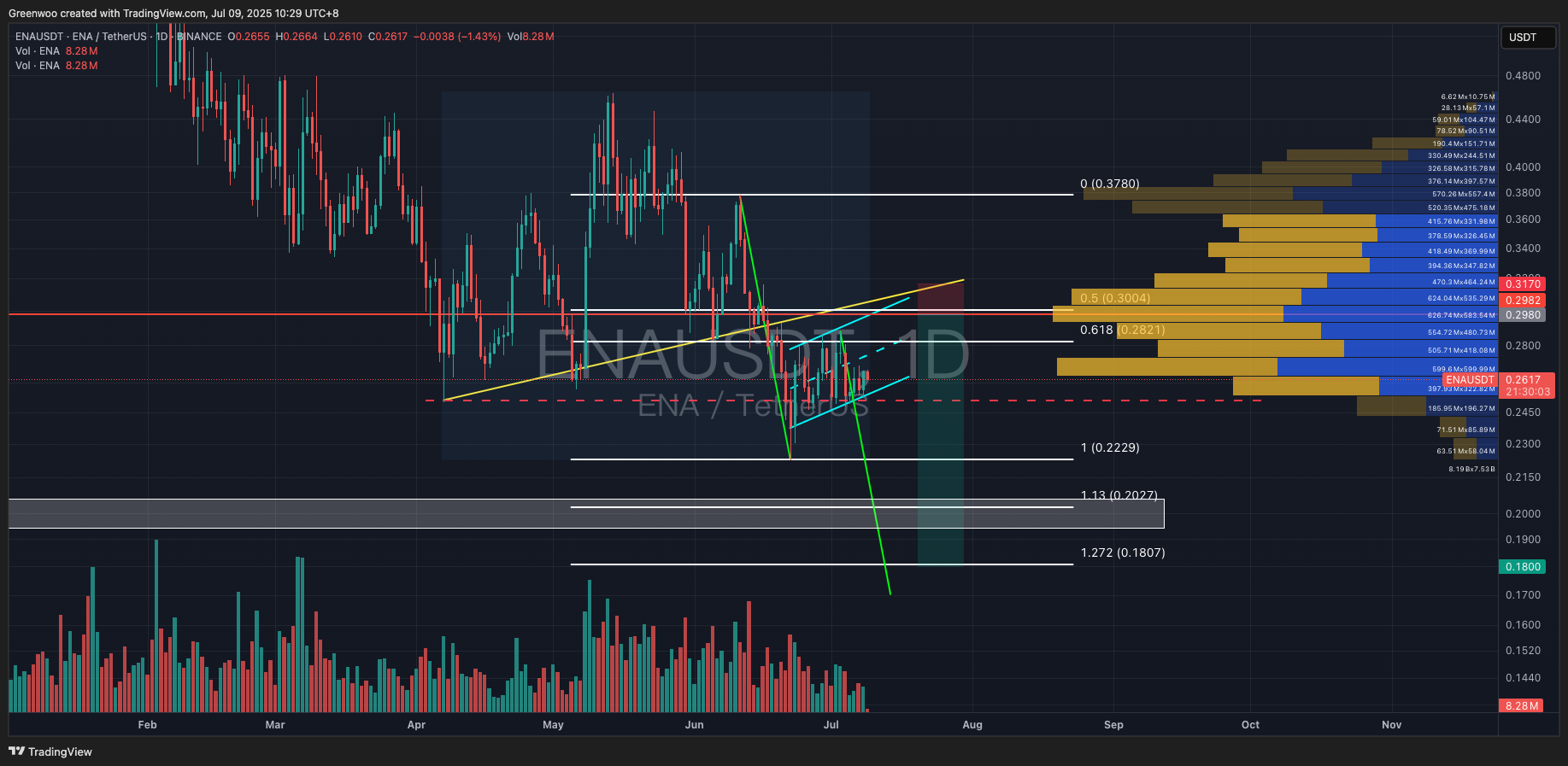

ENA

After breaking below the trendline, ENA has entered short-term consolidation, with the price forming a small flag pattern (light blue parallel channel). This suggests a potential continuation of the trend. The earlier break below the trendline coincided with a drop below the April 7 low of $2.5, falling to $0.2225 before finding support and pulling back. This indicates significant bearish pressure, reinforced by the flag pattern, signaling a likelihood of further downside.As of writing, ENA is priced at $0.263. Investors can consider entering short positions at the current market price, though waiting for a better entry point is also viable as the price has not yet broken out of the flag pattern. Entry prices between $0.283 and $0.3 are favorable. Take-profit levels can be set in batches at $0.223, $0.21, and $0.18. The stop-loss can be set based on individual risk tolerance, with a maximum of $0.317.

Reference Levels:

Direction: Short

Entry: $0.263 (market price) / $0.283 - $0.3

Take Profit: $0.223 / $0.21 / $0.18

Stop Loss: $0.317

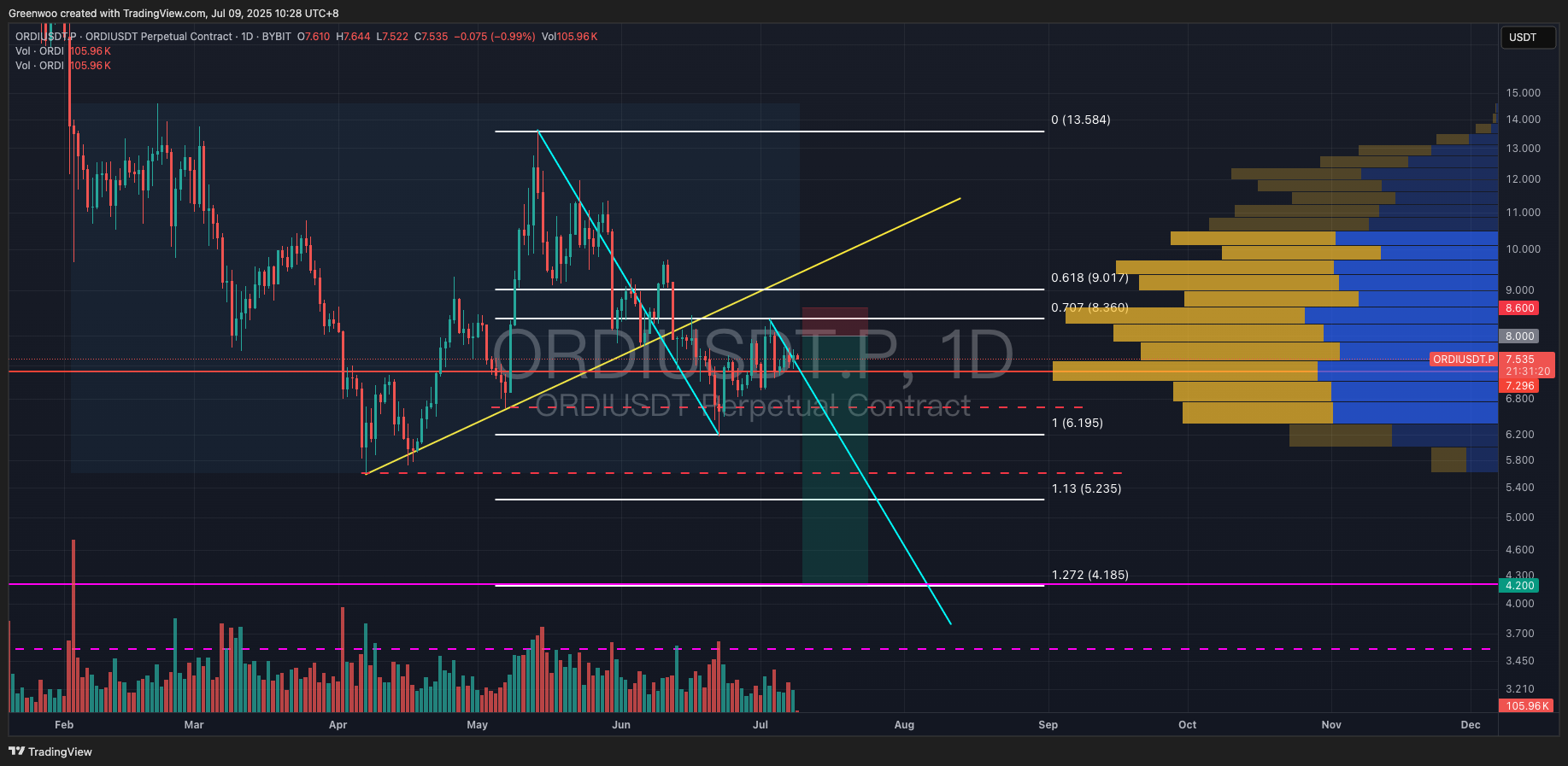

ORDI

ORDI’s price action mirrors ENA, with a break below the trendline followed by short-term consolidation. The price is forming a pattern close to a flag, suggesting the downtrend may continue, with further declines likely.After breaking the trendline on June 13, ORDI rallied to $8.44 on June 16 but faced resistance and fell. On July 3, it reached $8.36 before encountering resistance again, indicating strong pressure at this level.As of writing, ORDI is priced at $7.6. Investors can enter short positions at the current market price or wait for better entry points. Prices between $8 and $8.3 are good choices. Take-profit levels can be set in batches at $6.2, $5.6, $5.25, and $4.2. The stop-loss should be set above the June 16 high of $8.44.

Reference Levels:

Direction: Short

Entry: $8 - $8.3

Take Profit: $6.2 / $5.6 / $5.25 / $4.2

Stop Loss: $8.5

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.