[Bitop Review] Crypto Analysis: BTC, ETH, SOL

2025年06月10日发布

BTC

After two weeks of decline, BTC found support at $100,400 and rebounded, successfully holding above $100,000. Yesterday, the price surged, breaking out of a descending channel (purple parallel channel) with a daily gain of 4.28%. The price targets were $110,530, slightly below the previous high of $110,718, and it is currently trading around $103,000 at the time of writing.

The price is expected to retest the support zone, offering investors an opportunity to establish long positions. The entry range is approximately $104,300 to $105,500, aligning with the Fibonacci 0.382 to 0.5 levels. The high-volume trading zone is between $102 and $108,700, suggesting entries at the confluence of these levels.

Profit targets, based on pattern measurement (aqua line), could reach up to $122,000. Partial profits are recommended at Fibonacci levels 1, 1.414-1.618, and 2. Stop-loss levels, depending on individual risk tolerance, range between $103,500 and $99,999.

Reference Levels:

Direction: Long

Entry: $104,300 - $105,500

Take Profit: $110,500 / $111,800 / $115,500 - $116,666

Stop Loss: $103,500 / $99,999

ETH

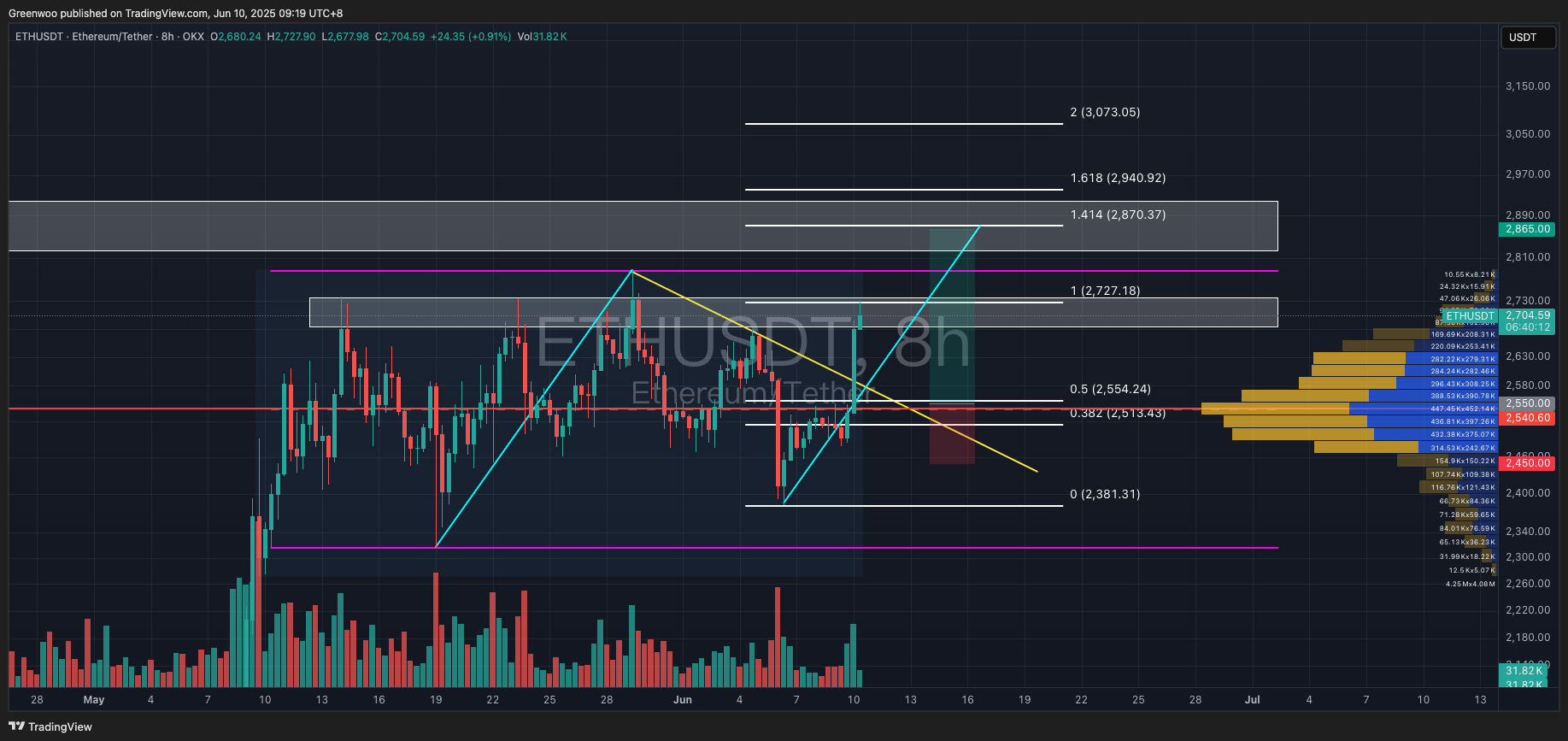

ETH remains within a broad trading range (purple parallel channel). Yesterday, the price broke above a minor trendline (yellow line) but faced resistance near $2,730, which coincides with an upper resistance zone (white block).

The breakout, with a 5% move, is considered a valid signal. The price is expected to retest support, where investors can consider long positions. The entry point is around $2,550, aligning with the Fibonacci 0.5 level, a high-volume zone, and the midpoint of the trading range, indicating strong support from multiple technical factors.

Profit targets, based on pattern measurement (aqua line), are around $2,870, coinciding with Fibonacci 1.414 and the upper resistance zone (white block). Stop-loss levels, based on individual risk tolerance, range between $2,450 and $2,380 (previous low).

Reference Levels:

Direction: Long

Entry: $2,510 - $2,555

Take Profit: $2,730 / $2,870

Stop Loss: $2,450 / $2,380

SOL

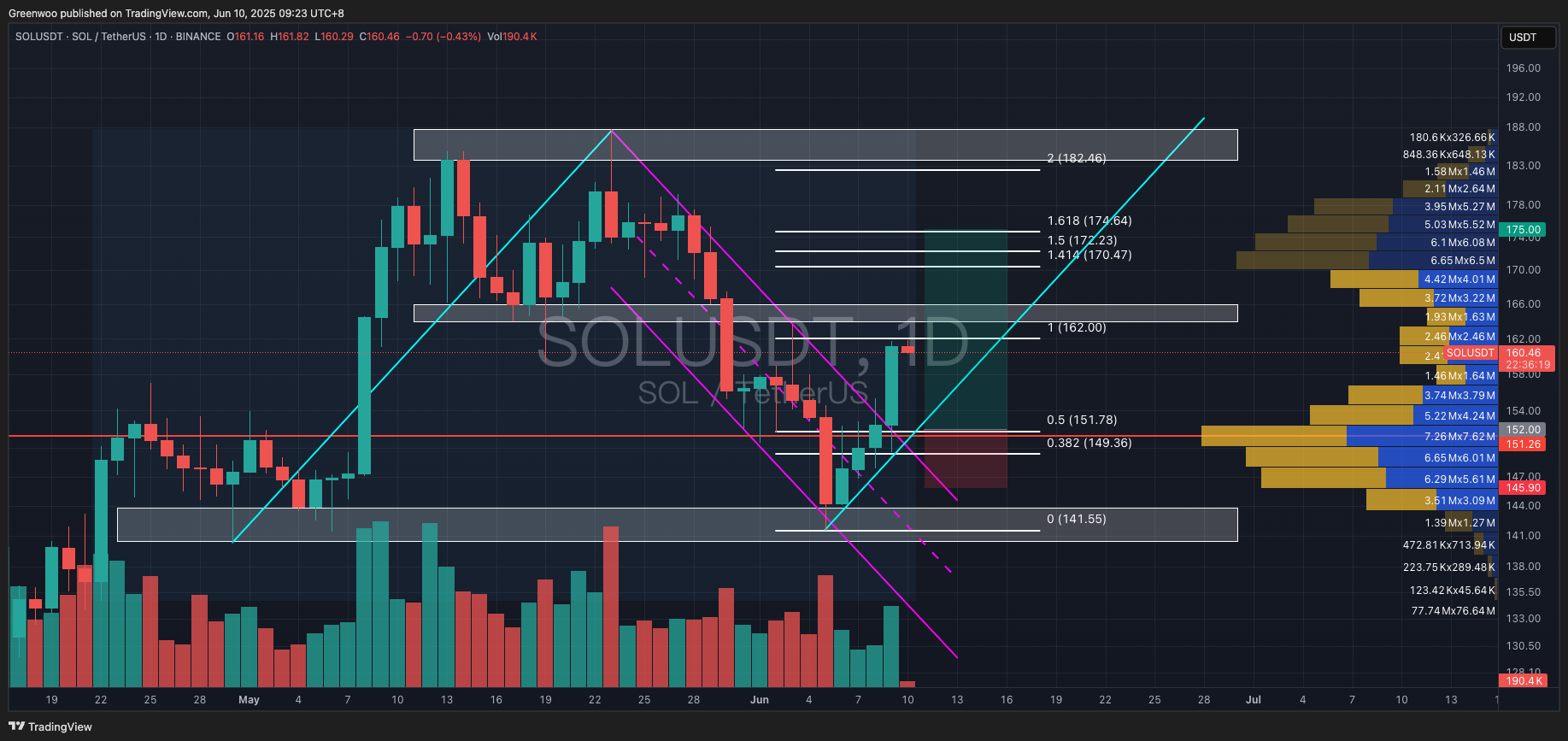

Similar to BTC, SOL found support at $141.5 after two weeks of decline, holding above the $140 level. Yesterday, the price broke out of a descending channel (purple parallel channel) with a 6.5% move, facing resistance at $161.8.

The price is expected to retest support, offering an opportunity for long positions. The entry range is between $150 and $155, aligning with Fibonacci 0.5 to 0.618 and a high-volume zone. Profit targets are between $170 and $175, with partial profits at $162 and $187. Stop-loss levels, based on individual risk tolerance, are between $146 and $141.

Reference Levels:

Direction: Long

Entry: $150 - $155

Take Profit: $162 / $170 - $175 / $187

Stop Loss: $145.9 / $140.9

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.