[Bitop Review] BTC Surpasses $110,000: Spot ETFs See $1.68 Billion in Net Inflows Over Five Days, Analysts Highlight Trading Volume as Key

2025年05月22日发布

Bitcoin has set a new historical high! On the morning of May 22, after 7 a.m., Bitcoin's price successfully reached $110,797, adding brilliance to the annual Bitcoin Pizza Day.

Bitcoin Nears Acceleration Phase

Bitcoin has entered a breakout range historically associated with sustained explosive growth.

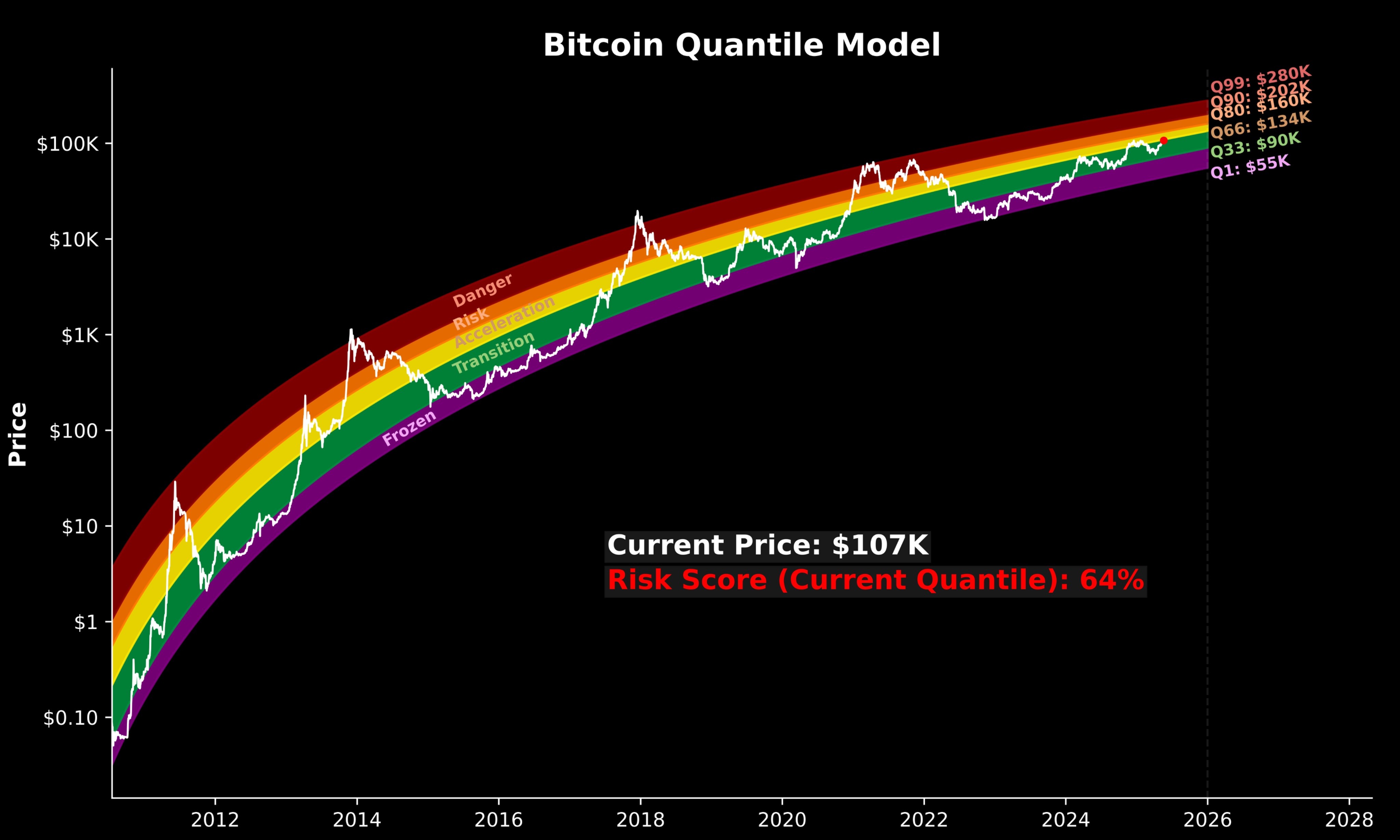

According to the Bitcoin Quantile Model, the current market exhibits heat similar to the post-Trump election period and the Q4 2024 spot ETF-driven highs. This model uses quantile regression on a logarithmic scale to map Bitcoin’s price phases, indicating that Bitcoin is currently in a “transition zone,” a critical juncture before entering the “acceleration phase.”

Once this phase begins, it could trigger Bitcoin’s next wave of gains. The model predicts Bitcoin could gradually reach price levels of $130,000 and $163,000 in the coming months.

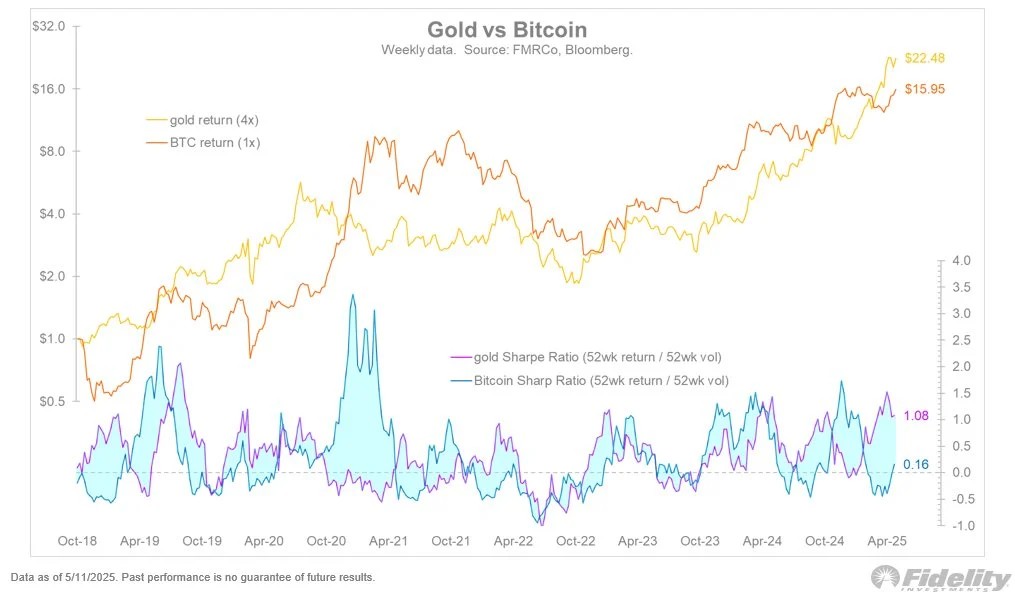

Additionally, data analysis shows Bitcoin’s Sharpe ratio aligning closely with gold’s recently. Fidelity’s Global Macro Director, Jurrien Timmer, suggests investors adopt a 4:1 gold-to-Bitcoin allocation for portfolio diversification.

Trading Volume is the Key

Last night, concerns over the U.S. government’s fiscal deficit intensified due to Trump’s proposed tax reforms, which could expand the deficit by $3.8 trillion over the next decade if passed. This led to a 20-year U.S. Treasury auction yield hitting 5.047%, the highest since the second half of 2023, prompting capital flight from equities as all four major indices declined.

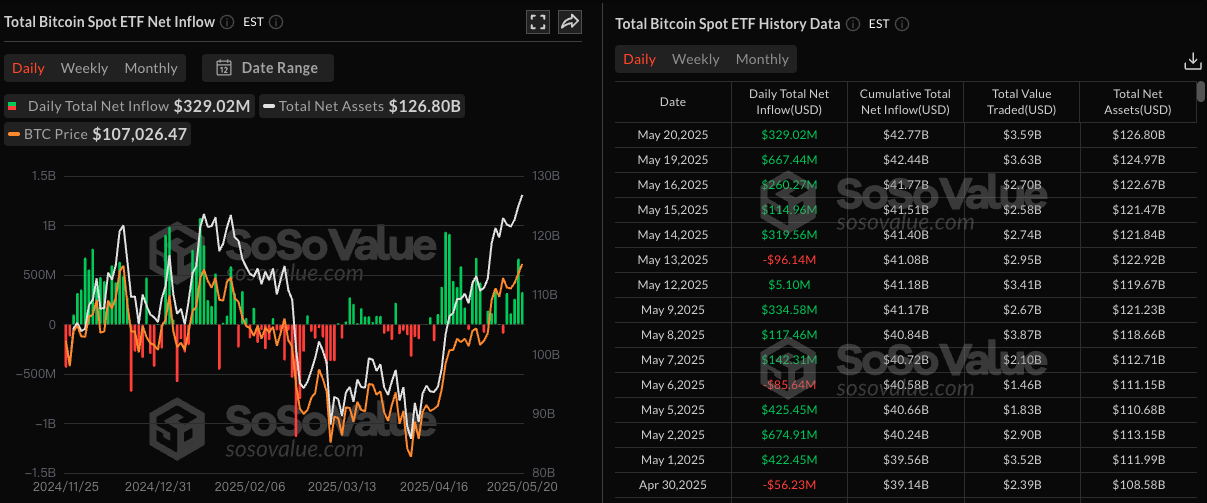

For Bitcoin to achieve a sustained breakout, trading volume must remain elevated over multiple days. Whether the price rise is accompanied by increasing volume will be a critical indicator of a lasting breakthrough. Currently, U.S. spot Bitcoin ETFs continue to attract significant capital, with only two days of net outflows in May, and those were minimal. This consistent inflow supports bullish momentum and provides price stability.

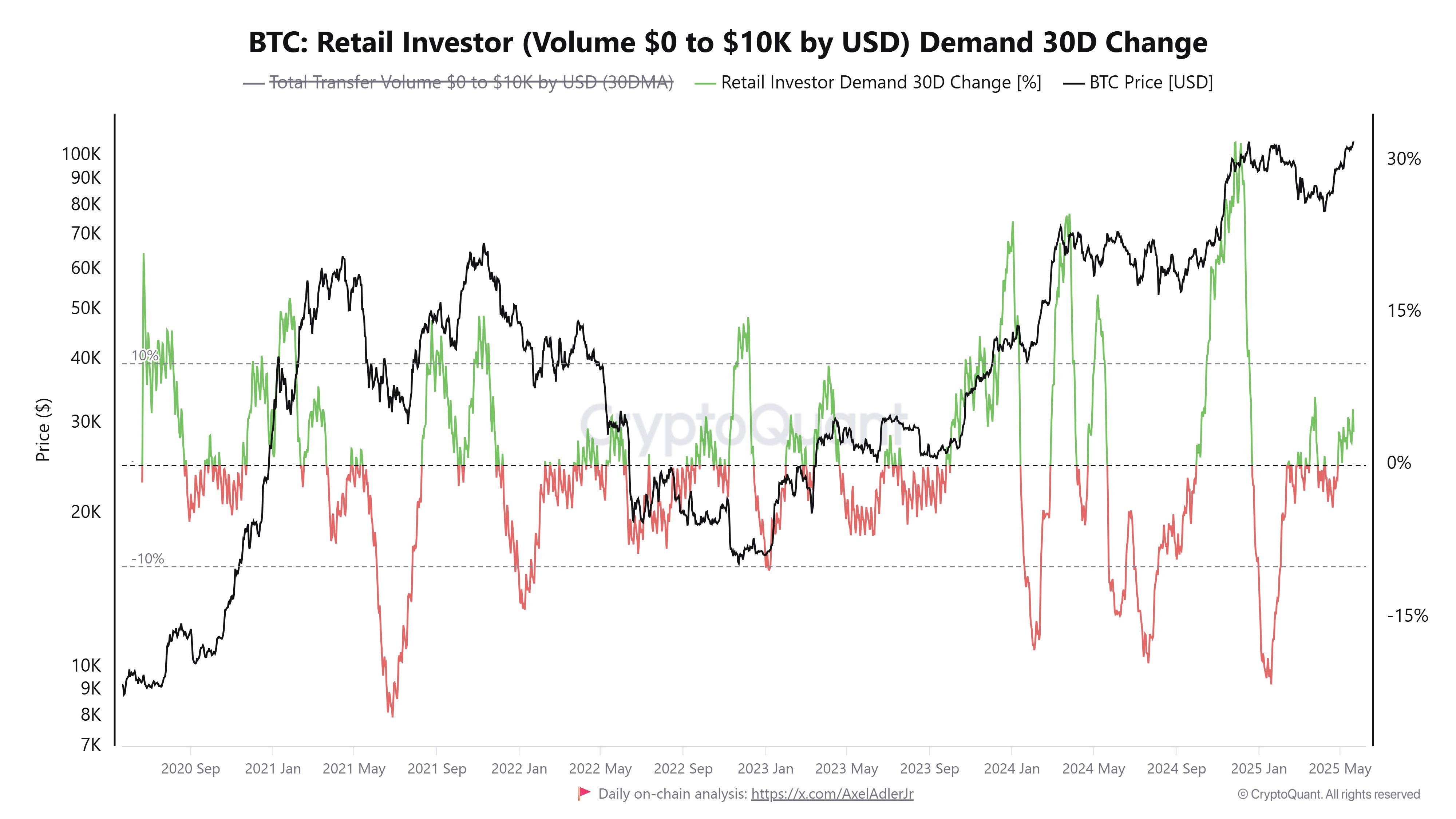

Meanwhile, CryptoQuant data shows retail investor demand on May 21 accounted for just 3.2% of the market, far below the 30% level seen in December 2024. This suggests retail participation has not yet peaked, potentially bringing fresh capital to sustain the rally.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.