[Bitop Review] Technical Analysis: BTC, SOL, SUI

2025年04月23日发布

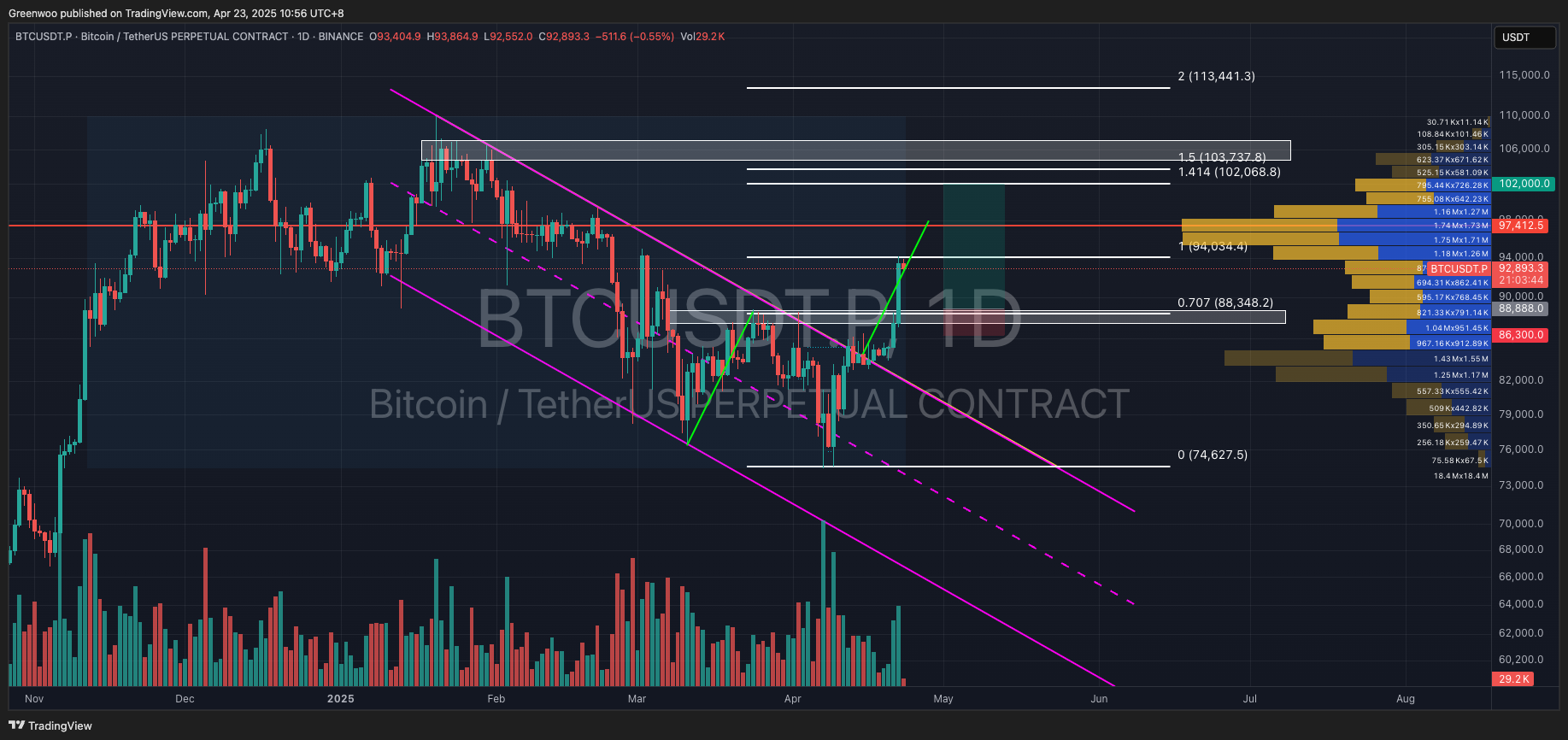

BTC

BTC broke through a key resistance zone yesterday, with gains stalling near the previous high of $94,140. As of writing, it is trading at $92,760, up 5.5% in the last 24 hours.

The head-and-shoulders bottom pattern was invalidated after the breakout, but the bullish trend remains intact. Following the breakout of the descending channel, a pullback test is likely, offering investors a potential entry opportunity. Key support lies around $87,800–$88,800, which would be a relatively good entry zone if the price retraces to this level.

Take-profit targets are at two levels: the first near $97,350, a high-volume trading zone and a previous resistance level, which also aligns with the measured target of the channel breakout. The second target is around $102,000–$104,000, corresponding to a prior high and the Fibonacci 1.414–1.5 levels. Set stop-loss below $87,000.

Summary of Reference Levels:

Direction: Long

Entry: $88,888 ($87,800–$88,888)

Take-Profit: $97,400 / $102,000–$104,000

Stop-Loss: $87,000

SOL

SOL has performed strongly recently, with bullish momentum clearly outweighing bearish pressure. Yesterday’s rally broke through a trendline, stalling near the previous high of $150, a key resistance zone.

SOL has broken two descending trendlines (yellow and green lines in the chart), signaling a potential trend reversal. Investors may consider entering on a pullback following this breakout. Take-profit targets are near $177 and $199, with a stop-loss below $129, which aligns with a high-volume zone and the Fibonacci 0.618 level.

Summary of Reference Levels:

Direction: Long

Entry: $138

Take-Profit: $177 / $199

Stop-Loss: $128

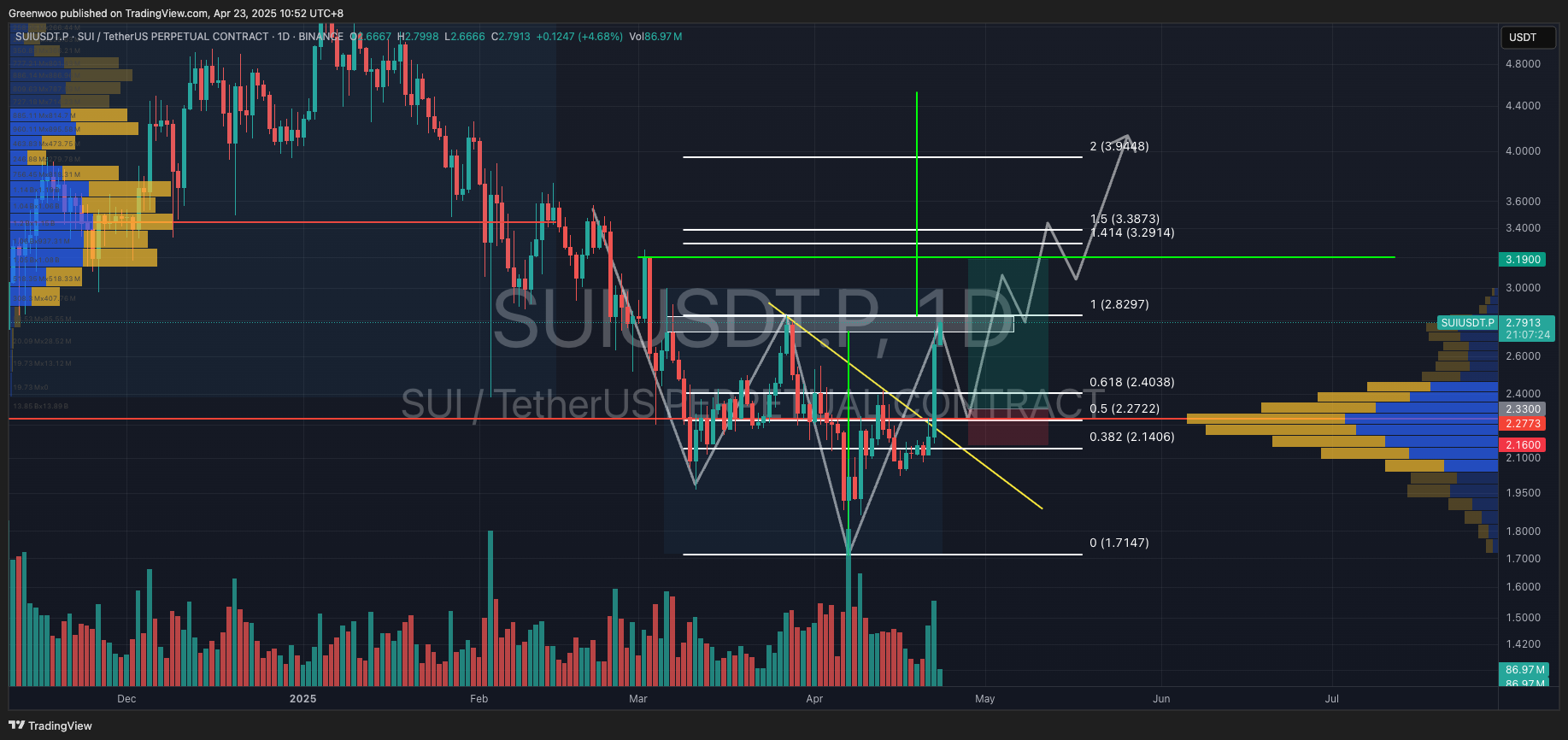

SUI

SUI followed the broader market rally yesterday, breaking a descending trendline (yellow line in the chart) and reaching $2.75. Today, it continued its upward move, peaking at $2.8 but failing to break the resistance zone. As of writing, it is trading at $2.751, up 23.28% in the last 24 hours.

Investors can wait for a pullback, with a relatively good entry zone around $2.25–$2.39 (Fibonacci 0.5–0.618), which is a support zone and a high-volume trading area.

Take-profit can be scaled between $3.19 and $3.5, with a stop-loss set below $2.16.

Summary of Reference Levels:

Direction: Long

Entry: $2.33 ($2.25–$2.39)

Take-Profit: $3.19 / $3.5 / $3.89

Stop-Loss: $2.15

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.