[Bitop Review] MicroStrategy's Saylor Acquires Another 3,459 Bitcoins: Michael Saylor Leads MicroStrategy's Bitcoin Investment Surge, Captivating Global Investors

2025年04月21日发布

Michael Saylor, the founder of MicroStrategy, continues to ramp up his investment in Bitcoin. The company now holds over 530,000 Bitcoins, with a total market value of $46.5 billion. Saylor recently took to social media to affirm his commitment to further Bitcoin accumulation, revealing that MicroStrategy’s stock, MSTR, has attracted direct investment from over 13,000 institutional investors and 814,000 retail investors. Beyond that, an estimated 55 million individuals are believed to hold MSTR indirectly through channels such as ETFs, mutual funds, and pension funds. In its most recent transaction, MicroStrategy purchased 3,459 Bitcoins on April 14 at $82,618 per coin, spending more than $285 million. The company currently owns 531,644 Bitcoins, boasting unrealized profits of nearly $45.2 billion.

Saylor Channels Funds into Bitcoin Through 'Debt and Equity Issuance'

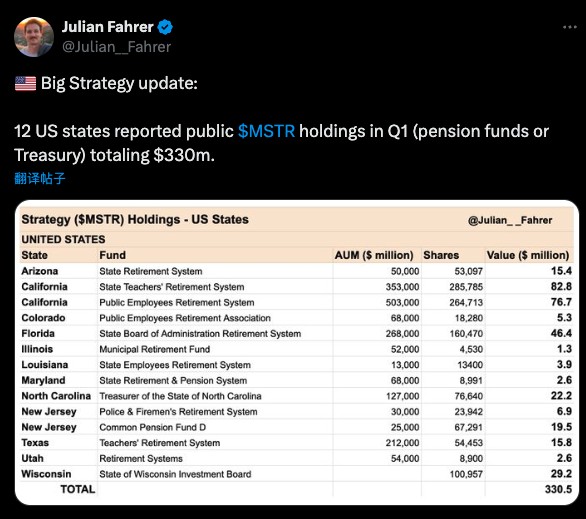

MicroStrategy doesn’t rely solely on cash to acquire Bitcoin. Instead, it raises capital by issuing corporate bonds and stocks, effectively diverting funds from traditional financial markets into the Bitcoin ecosystem. This approach positions MSTR stock as an indirect avenue for Bitcoin investment. Currently, pension funds or investment entities from at least 12 U.S. states—including California, New Jersey, Texas, and Utah—hold MSTR stock, highlighting its broad market reach. Meanwhile, as of April 17, Bitcoin ETFs have recorded a cumulative net inflow of approximately $2.4 billion, lending additional support to the market and easing short-term selling pressure.

Saylor Directs Institutional Capital into Bitcoin, Potentially Fueling the Next Bull Market

In summary, MicroStrategy’s strategy has emerged as the cryptocurrency world’s most notable "capital diversion" model. The goal is to gradually inject significant institutional funds—along with qualities like "conviction"—into Bitcoin’s finite market, driving its price upward. Through frequent social media updates, Michael Saylor signals his intent to keep accumulating Bitcoin, drawing substantial investor attention. With 530,000 Bitcoins in his arsenal, he could play a pivotal role in the next bull market, serving as a major force in shaping market dynamics.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.