[Bitop Review] White House Crypto Summit + Trump’s New Policy: Is Bitcoin Becoming “Digital Gold”?

2025年03月07日发布

With the inauguration of U.S. President Donald J. Trump’s new administration, the cryptocurrency industry is gearing up for a highly anticipated event—the inaugural White House Crypto Summit, set to take place at 2:30 AM Beijing time on March 8. This summit not only marks a significant turning point for the crypto sector but also aligns with Trump’s recently signed executive order establishing a “Strategic Bitcoin Reserve,” signaling the official launch of America’s strategic positioning in the global digital asset landscape.

The Crypto Summit: A Symbol of Industry Transformation

Hosted by White House Crypto Czar David Sacks and Bo Hines, Director of the President’s Digital Asset Advisory Council, the summit is expected to bring together over twenty top executives and prominent figures from the cryptocurrency world. Attendees include Coinbase CEO Brian Armstrong, MicroStrategy founder Michael Saylor, and Chainlink co-founder Sergey Nazarov, among others.

For crypto industry insiders, this event carries profound significance. Since the collapse of FTX in 2022 dealt a heavy blow to the sector, the political climate in the U.S. has undergone a dramatic shift. JP Richardson, CEO of digital wallet provider Exodus, remarked, “Looking back to 2022, the Biden administration was openly hostile to our industry. Now, being able to discuss crypto policy with the president in the White House shows that this administration is taking it seriously.” Christopher Giancarlo, who served as chairman of the Commodity Futures Trading Commission during Trump’s first term, added that the summit fulfills Trump’s pledge made at last year’s Bitcoin Conference in Nashville to support the crypto industry.

Meanwhile, since Trump took office, the U.S. Securities and Exchange Commission (SEC) has paused or dismissed lawsuits and investigations involving at least ten cryptocurrency firms, including Robinhood and Uniswap Labs. These moves have injected confidence into the industry, drawing more companies to participate in this historic summit.

Strategic Bitcoin Reserve: America’s “Digital Gold” Strategy

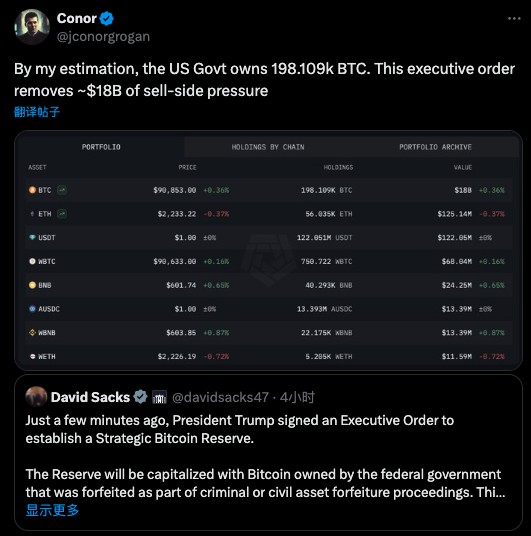

On the eve of the summit, Trump signed an executive order on March 6, officially establishing the “Strategic Bitcoin Reserve” and the “U.S. Digital Asset Stockpile.” This policy designates Bitcoin as a national strategic asset, with the Treasury Department tasked with its management. The primary source of the reserve will be Bitcoin seized by the federal government through criminal or civil forfeiture. The order specifies that all Bitcoin deposited into the reserve will be held long-term rather than sold, aiming to position it as a financial pillar akin to gold.

Additionally, the Treasury and Commerce Departments are authorized to develop budget-neutral strategies to acquire more Bitcoin, provided these efforts impose no additional costs on American taxpayers. This has disappointed some in the crypto community who had hoped for a more aggressive “government buying spree.” Alongside the Bitcoin reserve, a separate “Digital Asset Stockpile” will be established to hold other seized assets like Ethereum (ETH), XRP, and SOL, though the government has no plans to actively acquire more of these assets, with disposal authority resting with the Treasury Secretary.

This initiative not only addresses long-standing gaps in the U.S. government’s management of crypto assets but also responds to criticism over the more than $17 billion lost by taxpayers due to premature sales of Bitcoin at low prices. The new policy mandates agencies to submit reports on their digital asset holdings, establishing a transparent and unified regulatory framework to maximize the value of these assets.

Market Reactions and Controversies

Last Sunday, Trump announced plans to include BTC, ETH, SOL, XRP, and ADA in the crypto asset reserve, sparking an initial surge in Bitcoin prices. However, following the executive order’s release, Bitcoin dropped to $84,000, while the other named tokens experienced a widespread crash. Crypto Czar David Sacks faced scrutiny over potential conflicts of interest, with some questioning whether the inclusion of certain assets undermines the reserve’s credibility.

Nevertheless, optimists argue that the executive order could ease selling pressure in the market. The government’s commitment to not selling its strategic Bitcoin stash may provide long-term confidence. Dubbed “digital gold,” Bitcoin’s scarce 21 million coin supply has prompted nations to compete for holdings, and the U.S. is clearly aiming to secure a strategic edge in the global digital economy.

Fulfilling a Promise: Building the “Global Crypto Capital”

Since his campaign, Trump has vowed to make the U.S. the “global crypto capital.” In an interview, he stated, “I’m very open to crypto companies; we must lead in this field.” After taking office, he wasted no time delivering on this promise—signing the executive order within his first week, appointing David Sacks as Crypto Czar, and pushing forward with the White House Crypto Summit.

Through the establishment of the Strategic Bitcoin Reserve and Digital Asset Stockpile, the U.S. is not only bolstering its influence in the digital economy but also laying a foundation for effective crypto asset management. These actions demonstrate that the Trump administration is driving the crypto industry forward with concrete steps, ensuring America’s competitive edge on the global stage.

Conclusion

The White House Crypto Summit and the rollout of the Strategic Bitcoin Reserve are like two wings propelling the U.S. crypto industry into a new era. From an industry turning point to a national strategy, this is not only Trump fulfilling his promises to voters but also potentially a transformative shift in the global digital asset landscape. As the summit approaches, the world’s attention is fixed on the White House, eager to see what possibilities this event will unlock for the future of cryptocurrency.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.