[Bitop Review] Magnificent 7 Lead the Charge, Buying the Dip Boosts Stock Market, Bitcoin Falls Below 100,000 Again

2025年02月05日发布

The U.S.-China Trade War Begins

The U.S.-China trade war officially started as U.S. President Donald Trump delayed his plan to impose a 25% import tariff on Canada and Mexico by 30 days, but the 10% tariff on Chinese goods went into effect on February 4th Eastern Time. In response, China began imposing tariffs of up to 15% on U.S. imports starting from February 10th and launched an antitrust investigation against Google, marking the formal commencement of the trade war.

However, this time, China has imposed tariffs on only a limited number of products (about 80 types), valued at approximately $14 billion, far less than the $525 billion from the U.S. This indicates that China is currently adopting a more cautious approach compared to Trump's first term.

U.S. Labor Market Slows Down, Buying the Dip Lifts Stock Market

New data on U.S. job vacancies show that the labor market is slowing down. The December JOLTS (Job Openings and Labor Turnover Survey) reported 7.6 million job openings, against expectations of 8.01 million and a previous figure of 8.156 million. This data alleviated upward risks from Friday's employment report, which was beneficial for both the Federal Reserve and the market.

A wave of buying the dip pushed stock prices higher. Meta, the parent company of Facebook, saw gains for the 12th consecutive trading day, marking the longest streak of daily gains in its history.

Analysts believe the short-term market tension has proven to be a good opportunity for short-term investments.

Bitcoin Falls Below 100,000, But Market Share Rises

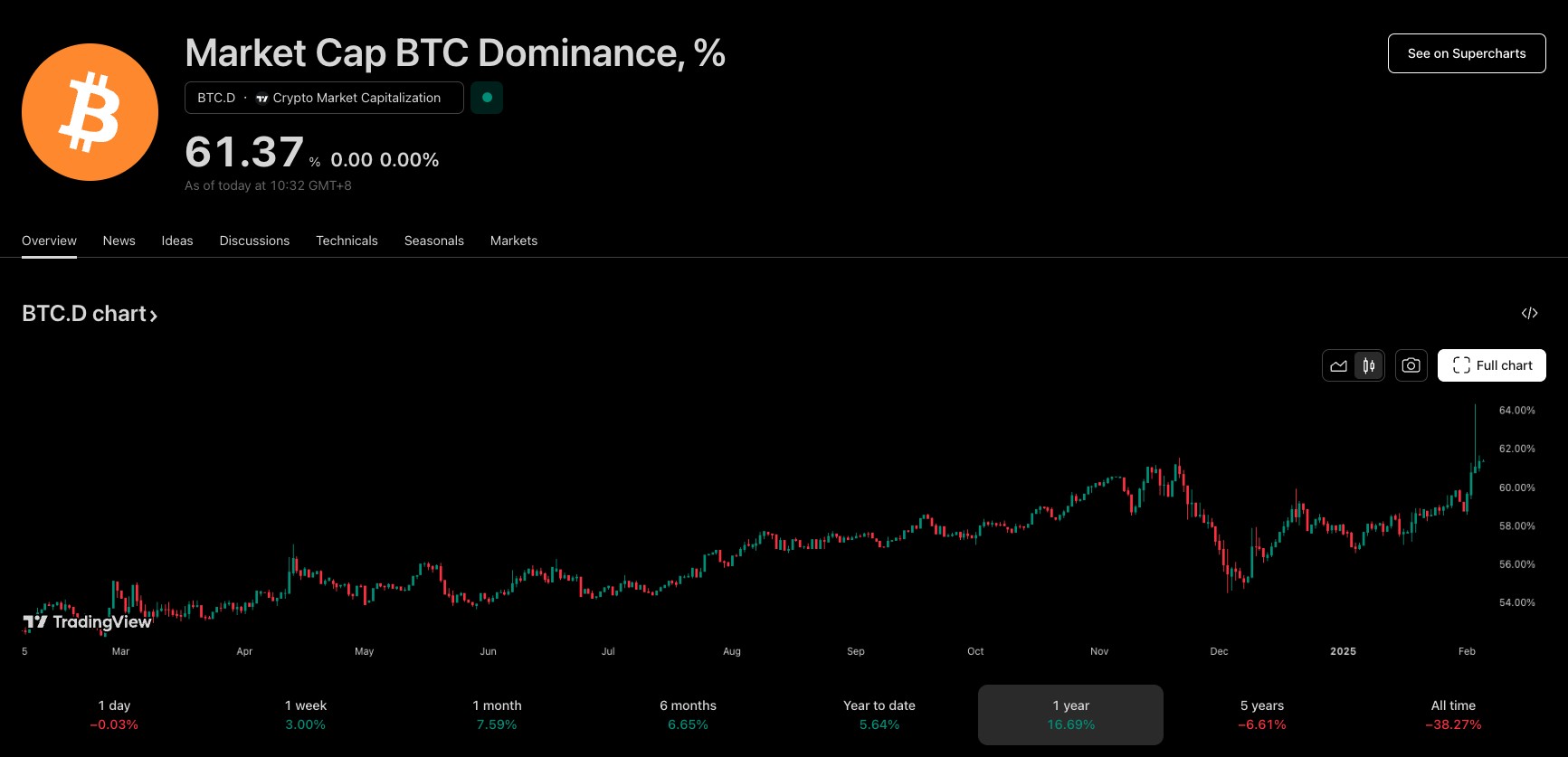

Bitcoin fell below the 100,000 threshold again, reaching a low of $96,150 this morning. At the time of writing, it was trading at $97,559, having dropped by 3.7% over the last 24 hours. However, Bitcoin's market share (BTC.D) has risen from a low of 54% in December to 61%.

This increase in dominance suggests a shift of funds from altcoins to Bitcoin, indicating that investors might be favoring cryptocurrencies with a longer market history and a more established follower base.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.