[Bitop Review] Bitcoin Plunges to $66,500, Ethereum Breaks Below $2,700: Healthy Correction or Trend Reversal?

2024年10月22日发布

After hitting $69,546 early yesterday morning, Bitcoin saw a surge in selling pressure. Last night, it dipped below $67,000 before plummeting to near $66,500 around 8:30 this morning, breaking below the low of October 17 and then recovering slightly. At the time of writing, it is trading at $67,592, down 2.32% in the past 24 hours.

The upward trend of Bitcoin seems to have been interrupted, and whether this decline is a healthy correction or a deliberate sell-off by major players remains to be seen.

Ethereum has performed even weaker. After reaching a high of $2,769 yesterday, it has continued to fluctuate downwards. At the time of writing, it is trading at $2,651, down 3.39% in the past 24 hours.

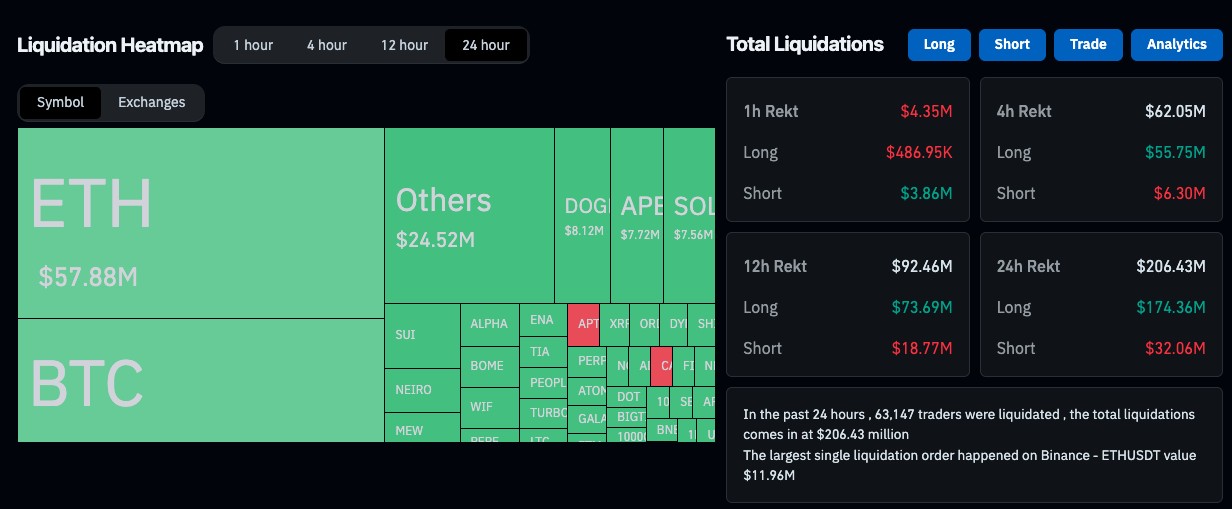

$206 Million Liquidated Across Exchanges in the Past 24 Hours

According to Coinglass data, over $206 million worth of cryptocurrency positions have been liquidated in the past 24 hours, with long positions accounting for $174 million. More than 63,000 traders have been liquidated.

Although the liquidation amount has increased compared to yesterday, it is not considered too severe based on historical data. Investors should still be cautious of potential volatility.

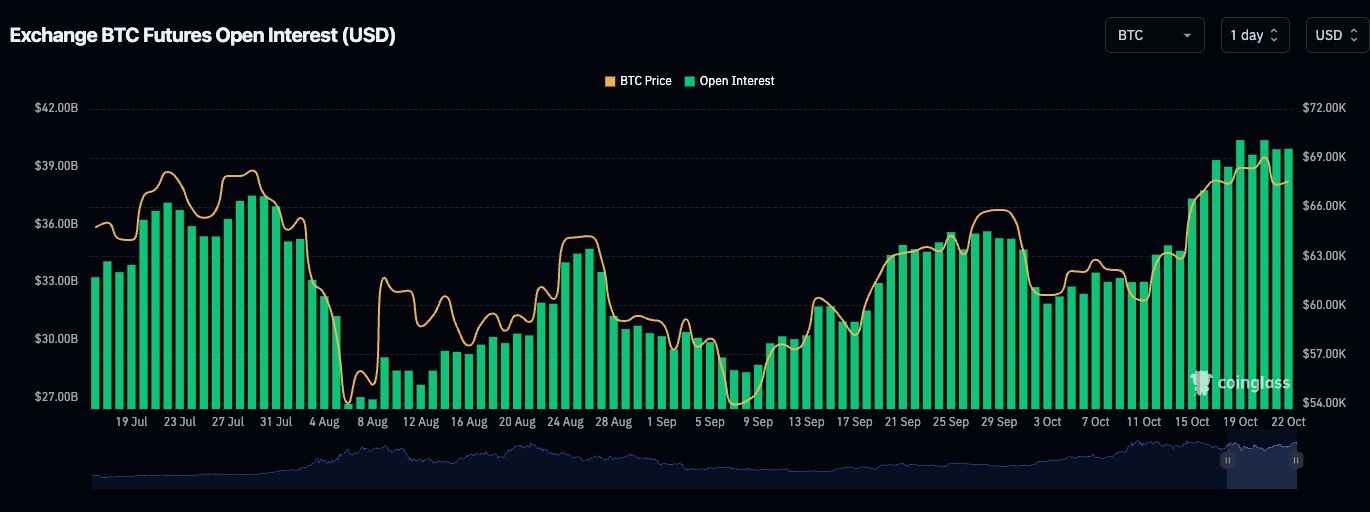

On the other hand, while the open interest of Bitcoin futures on exchanges has retreated from its all-time high of $40 billion, it remains at a relatively high level. The high leverage and holdings make the market more susceptible to significant fluctuations, and investors should be aware of the risks.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.